Calculate payroll withholding 2023

Check your payroll calculations. Aims to reduce the complexity of calculating how much to withhold and increase the transparency and accuracy of the withholding system.

Lightspeed Announces First Quarter 2023 Financial Results

CPP Deductions on Payroll.

. The amount of payroll expense dollar thresholds SMC 538030 The amount of the exemption SMC 538040A1 The amounts calculated shall be rounded to the nearest whole dollar. We recommend that you use the Payroll Deductions Online Calculator PDOC the publication T4032 Payroll Deductions Tables or the publication T4008 Payroll Deductions Supplementary Tables and the formulas in this guide for withholding starting with your first payroll in July 2022. Form 5208B Quarterly Unemployment Insurance Wage Detail.

If filed online you can use a payroll report that contains Name SSN Gross Amount Paid and Number of Hours Worked in a Quarter to balance prior quarters. Australia has a progressive tax system which means that the higher your income the more tax you pay. The following timetable will help you keep track of the important tax deadlines for submitting forms for the 2022 tax year.

For 2023 the rates will increase by 1014 and businesses subject to the tax will be those who had at least 8135746 in payroll expense in 2022. The premium for 2023 is 058 percent of an employees gross wages so. Payroll tax consists of.

DA-130 - Authorization for Electronic Deposit of Supplier Payment Form To obtain a copy of the DA-130 - Authorization for Electronic Deposit of Supplier Payment please have your agency submit a ManageEngine Service Desk ticket to request a copy of the form. Input your current loan amount as it is today. The amount of your CPP employee contributions the amount you pay into your plan and CPP employer contributions the amount the company you work for pays into your plan will depend on how much you earn.

Itemized deductions like mortgage interest and charitable contributions that will exceed your standard deduction. Or the Combined Federal Income Tax Employee Social Security Tax and Employee Medicare Tax Withholding Tables. You must pay these payroll taxes to the tax authorities.

This estimate is illustrative only and is derived from the differences between tax withholding and annual tax and may vary from your actual tax return. Wage Bracket Per-centage Method Tables for Automated Payroll Systems. Employees can access paid family and medical leave benefits starting in 2024.

However the IRS is no longer provid-ing the Formula Tables for Percentage Method Withhold-ing for Automated Payroll Systems. Additions To report withholding information for which no Form NYS-1 was filed make no entries in columns a and b. Calculate the total premium amount for each of your employees.

This is a more simplified payroll deductions calculator. Calculate the company car tax charge based on a cars taxable value and CO2 rating. Employers use these tables along with the information on your Form W-4 to calculate federal income tax withholding.

Colorados upcoming paid family leave program requires employers to start withholding and remitting employee and employer contributions in 2023. Paying taxes as a household employer requires you to fill out and file Schedule H along with your federal income tax return and pay the tax amount due by April 18 2023. Gross wages x 0058 total premium.

This calculator uses the redesigned W-4 created to comply with the elimination of exemptions in the Tax Cuts and Jobs Act TCJA. At the time of publishing these proposed changes were not law. The Form W-4 is now a full page instead of a half page and yet its still easier to understand.

Note that unlike Paid Family and Medical Leave premium contributions do not top out at the taxable maximum for Social Security. If on your original Form NYS-45 or on a prior Form NYS-45-X filed for the quarter you reported withholding information for which. ICalculators Australia Tax Calculator provides a good example of income tax calculations for 2023 it includes historical tax information for 2023 and has the latest Australia tax tables included.

You have to deduct payroll tax from your employees wages. Wage tax wage withholding tax and national insurance contributions step 9 Loonbelastingpremie volksverzekeringen berekenen in the Payroll Taxes Handbook pdf in. Rates and thresholds for employers 2022 to 2023.

Date of first pay. Australia 2023 Tax. You start your CPP employee contributions when you earn above the minimum amount which is known as the basic.

The first step the IRS implemented was to change the withholding tables. Enter the last payroll date and total withheld in the correct columns c and d only. Withholding schedules rules and rates are from IRS Publication 15 and IRS Publication 15T.

The new W-4 is an attempt to be more accurate in estimating your tax withholding so that you can get closer to owing 0 and getting a 0 refund when you prepare your tax return. The new W-4 system. Use this tool to calculate how long it will take to repay your loan.

How the W-4 form changed. Although 2023 will mark the first time in seven years that Social Securitys full retirement age will remain unchanged the upcoming year should bring six big changes. If you live in a zone for less than 183 days in 202223 you may still be able to claim a tax offset if you meet each of the following 3 conditions.

Do you employ staff in the Netherlands. Additional income that might not be subject to withholding like dividends or retirement income. Income Tax Rates in 2023.

Heres what you need to know. 183 days or more during the period 1 July 2021 30 June 2023 including at least one day in 202223 and you did not claim a zone tax offset in your 202122 tax return. Colorado employers dont put off getting to know this new law until the last minute.

We also offer a 2020 version of this calculator. Any extra withholding that you would like to withhold each pay period.

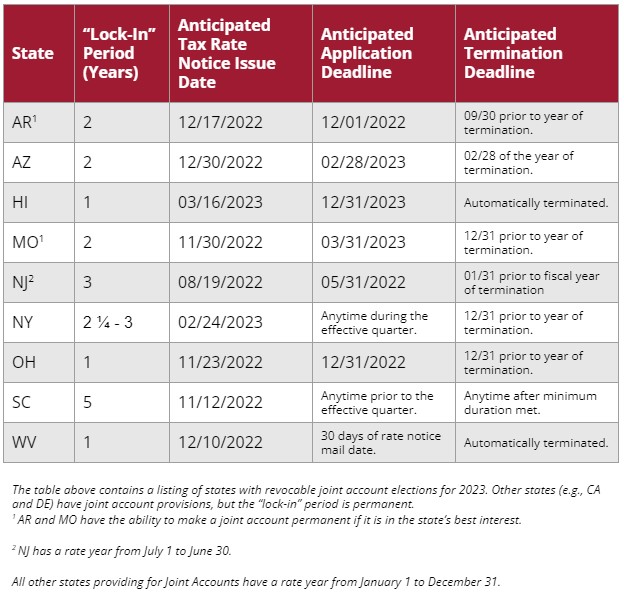

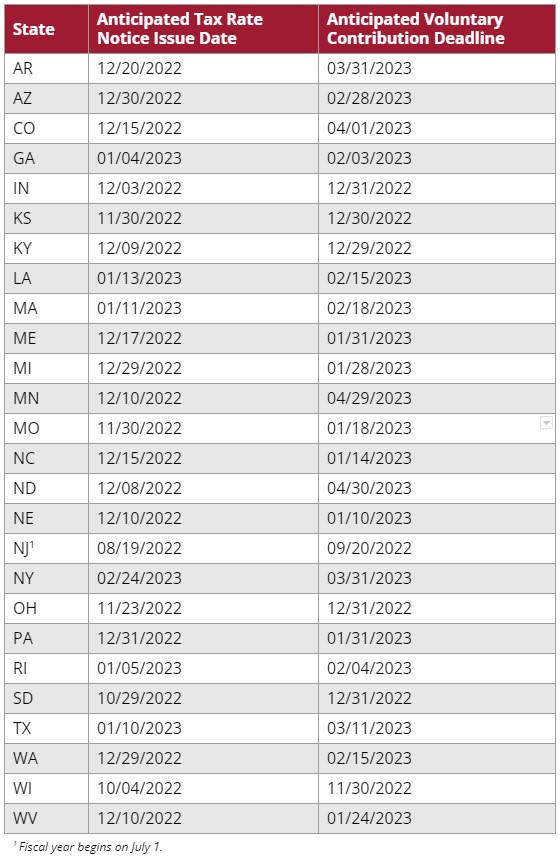

Planning Strategies To Help Reduce Sui Tax Burdens In 2023 And Beyond

Social Security What Is The Wage Base For 2023 Gobankingrates

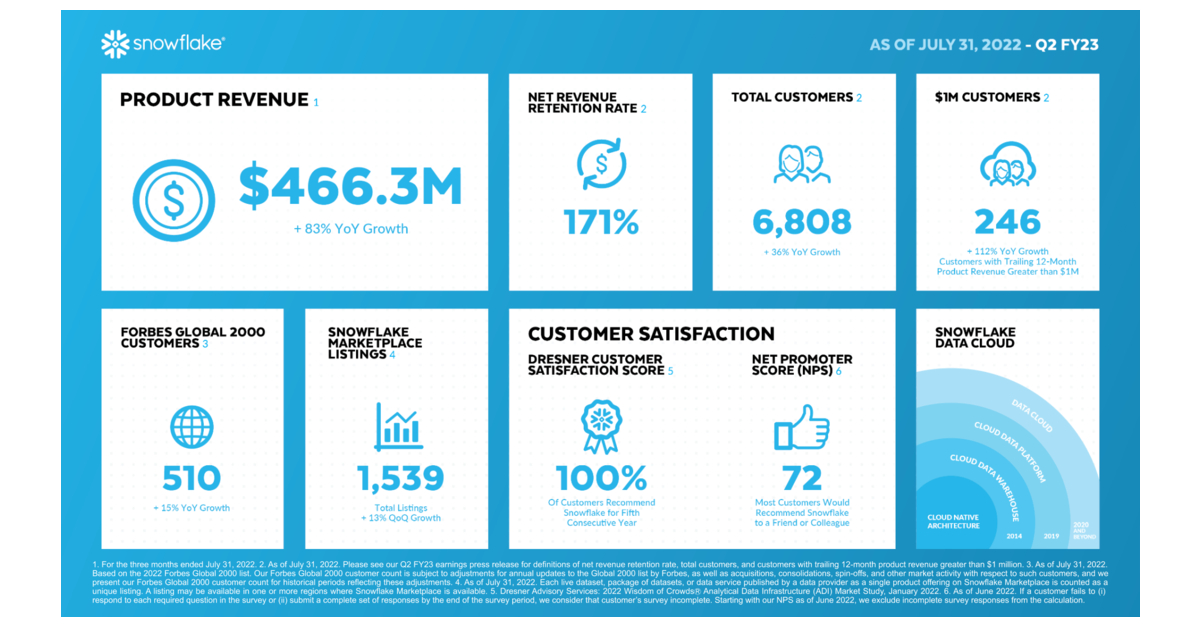

Snowflake Reports Financial Results For The Second Quarter Of Fiscal 2023 Fix Bdsthanhhoavn

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

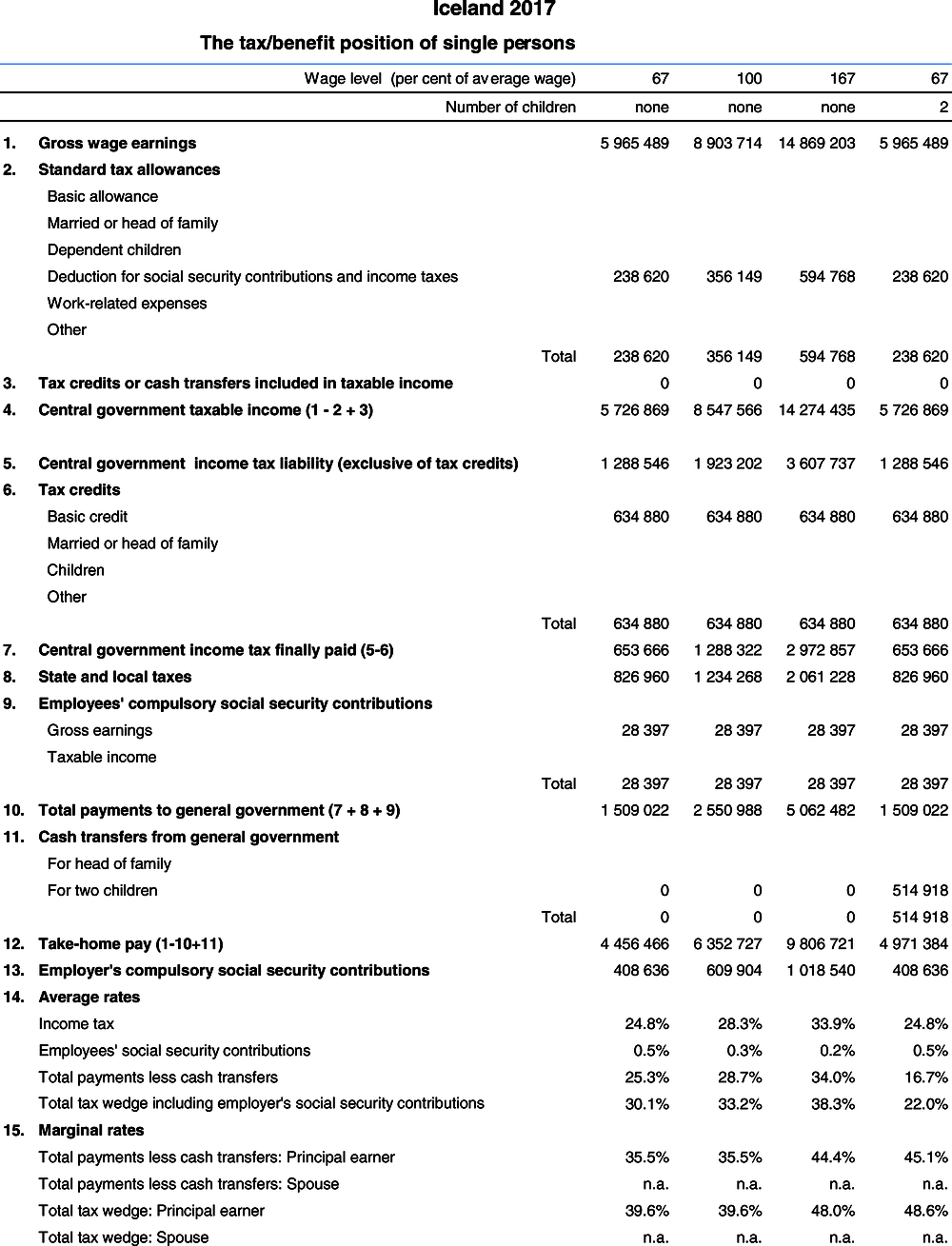

Home Oecd Ilibrary

4 Social Security Changes To Expect In 2023 The Motley Fool

My First Million By 16th October 2023 How To Get Money Credit Card App Business Travel Outfits

The 1 Social Security Change You Can Bank On For 2023 The Motley Fool

Page Not Found Isle Of Man Isle Quiet Beach

Snowflake Snowflake Reports Financial Results For The Second Quarter Of Fiscal 2023

State Corporate Income Tax Rates And Brackets Tax Foundation

New Salary Slab Rates Budget 2022 2023 Latest Updates Youtube

Solved How To Fix Payroll Error In Quickbooks Desktop

Estimated Income Tax Payments For 2022 And 2023 Pay Online

Planning Strategies To Help Reduce Sui Tax Burdens In 2023 And Beyond

Planning Strategies To Help Reduce Sui Tax Burdens In 2023 And Beyond

Biden Budget Biden Tax Increases Details Analysis